Calendar Year Q3 2023 is Indian Financial Year Q2 2023-2

In this Insight, ARC Advisory Group includes the most recent quarterly results for major Indian IT companies that publicly report their results.

We translated financials reported in Indian rupees to US dollars using an average exchange rate for the given reporting period. Owing to this translation, some companies may show negative growth.

Companies have substantially increased the hiring of fresh graduates to expand the talent pool of skilled employees, which should hopefully address the shortage of skilled workers and reduce the cost of delivery.

Financial results during calendar period from July 1 to September 30.

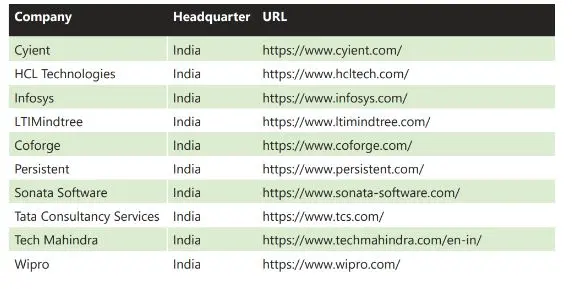

India’s information technology (IT) services industry witnessed a lagging muted sequential growth in Q2 amid sustained macroeconomic uncertainties in the key markets of the US and Europe.

Major Indian IT companies, including TCS, Infosys, HCL Tech, and Wipro have reported subdued earnings for the July-September quarter (Q2) due to the impact of ongoing macroeconomic uncertainties.

IT Services companies reported a logging muted sequential growth in Q2 due to perpetual macro overhanging an otherwise seasonally strong quarter.

We expect the companies that we covered to report steady sequential revenue growth on good demand, healthy deal wins, and active mergers and acquisition activities.

The second quarter performance of the top leading Indian IT services companies like TCS, Infosys, HCLTech, and Wipro have resulted in a not-so-bright forecast due to the global macroeconomic conditions leading to an uncertain demand environment from key markets like the US and Europe.

The Indian IT Sector must reset their goals to a level higher than the pre-COVID for a long-term growth rate, as these large companies have realized and accelerated the role of technology for survival and growth.

The trio - TCS, Infosys, and HCLTech, have announced multiple large deals.

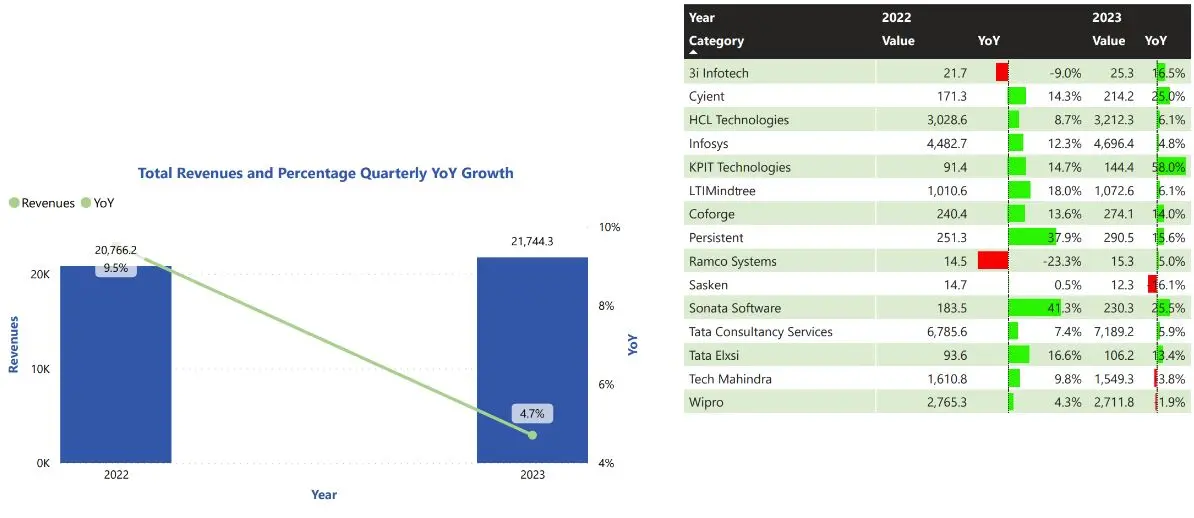

The IT services sector delivered a soft and muted growth compared to last year. Indian IT & Services industry recorded combined quarterly revenue of $21.7 billion and recorded 4.7percent year-over-year (YoY) growth as compared to last year.

The only positive seen in this quarter are from the large Indian IT companies like TCS and Infosys announcing their large deal wins, which will instill confidence in the IT sector.

Sectors such as banking, financial services, and insurance (BFSI), retail, hi-tech, and communication continue to show signs of softness, in the face of increasing rise and declining consumer spending.

However, the worsening macroeconomic conditions are tightening spending on transformational initiatives and non-critical multi-year projects.

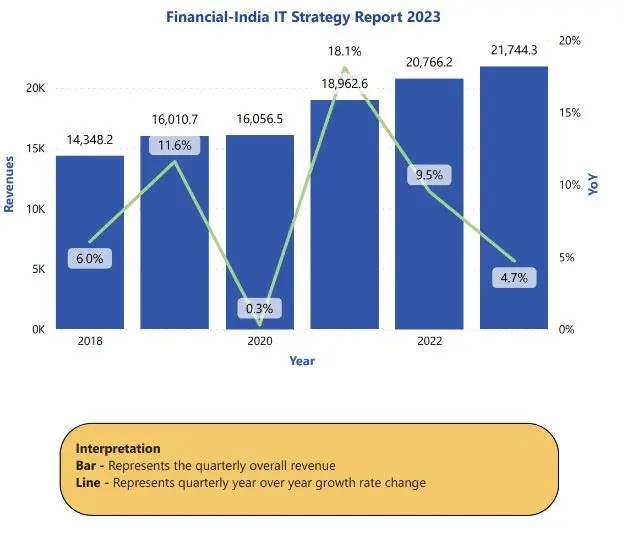

Cyient is a global engineering and technology solutions company. The company leverages digital technologies, advanced analytics capabilities, domain knowledge, and technical expertise to solve complex business problems. Cyient partners with customers to operate as part of their extended team in ways that best suit their organization’s culture and requirements. Cyient’s industry focus includes aerospace and defense, healthcare, telecommunications, rail transportation, semiconductor, geospatial, industrial, and energy. The high adoption of advanced technology and focus on fuel efficiency are likely to create ample growth opportunities for the market in the aerospace industry. Developments in electrification, hydrogen fuel option, and digital technologies will expand service revenue and create new opportunities.

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

Learn new ideas, establish valuable relationships, and refine your company's strategy at ARC’s Upcoming Forums.