As with many other industries in the year of the pandemic, the global automotive industry has struggled. In the two years prior (2018, 2019) to the pandemic year of 2020, the automotive industry was already being buffeted by economic headwinds. Shrinking economic activity in some global regions, rising competition, tightening lending models that inhibited global demand, and generational changes in the use of mobility all contributed to a challenging market. Then came the gut punch of the COVID-19 pandemic and the resulting lockdowns of the first half of 2020, plunging automotive sales to historic lows.

But the pandemic elicited some unintended consequences, one being a consumer shift back towards personal mobility over public and shared transport, which is helping the auto industry to revive at a faster than expected rate. However, even as the auto industry begins to make measured recovery, the face of the industry and its manufacturing will be vastly different going forward as the global auto industry makes the monumental shift from internal combustion engine (ICE) vehicles to electric vehicles (EV).

Despite the global pandemic-related economic crunch, it appears that the prospects for electric mobility are better than ever. While global auto sales plunged during the COVID-19 crisis, the electric mobility market has remained remarkably resilient in some countries. The 2020 pandemic has unquestionably impacted the overall global light vehicle (LV) market, and analysis of long-term market dynamics in automotive sales indicate that the recovery for the global electric vehicle (EV) market will be quicker, especially in China and Europe where strong growth is projected post pandemic. As auto OEMs prepare to ramp up production, many are prioritizing EV production lines to meet the expected strong consumer demand, fulfill regional regulatory requirements, and contribute to the global effort to contain global warming.

To meet the significant challenges of manufacturing the next generation of mobility, car makers are embracing technologies that will be essential to the production of vehicles that completely depart from previous manufacturing methods and processes. Next generation intelligent automation along with the implementation of cognitive manufacturing powered by AI, advanced analytics, and digital twin implementation will optimize production processes, cut costs, and help automotive manufacturers reach pre-pandemic production rates faster and more efficiently. The emergence of material science is also spawning a range of new materials, along with additive manufacturing, and human/robot collaboration that will significantly change the face of automotive manufacturing.

Automakers began to reinvent themselves as digital companies a few years back, but now that they are emerging from the business trauma of the pandemic, the need to complete the digitalization journey is more urgent than ever. They will have no choice as more technology-focused competitors adopt and implement digital twin-enabled production systems and move forward with EV and connected vehicle services, and autonomous vehicles not far behind. Car makers will make some tough decisions to bring software development in-house and some will even start building their own vehicle dedicated operating systems and computer processors or partner with some of the chip makers to develop next-generation O/Ss and chips to run on- board systems and future autonomous vehicles.

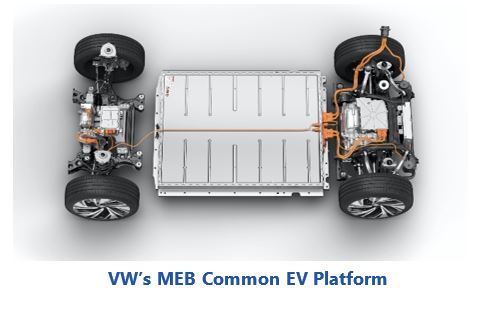

Designing and producing an electric vehicle involves engineering and integrating all elements, including the electric drive train, inverter, battery cells and battery pack, onboard charger, chassis design, package and body design, HVAC systems, and DC-DC converter for onboard systems. Moreover, manufacturing EVs will significantly change production lines and systems, and a workforce whose skillset has been dedicated to building ICE vehicles for many decades.

Each of these areas poses specific engineering and technological challenges and requires design tools that address the systems engineering requirements for integrating functional, logical, and physical systems to meet full vehicle integration. For example, the electric powertrain design process involves integrating complex engineering designs for motors, gears, torque converters, and other components with powertrain control system design, and electronics and performance design. Further, the electric drive design must consider factors, such as thermal requirements and constraints, electric voltage ripples, packaging, scalability, a common-part strategy, and, of course, manufacturability.

Car makers around the world are ripping up their old business models hoping to adapt to a new world in which electricity replaces gasoline and diesel-powered ICE vehicles. Currently, almost all global automotive companies have established an EV manufacturing strategy and process with many offering a complete line of EVs of either new models or electric versions of their existing models. Some, like Volvo cars (currently owned by the Chinese company Geely), are abandoning the production of ICE powered vehicles altogether. American companies like Ford plan to electrify their entire model line, having recently released the all-electric F-150 Lightning. The iconic Ford F-150 truck is the largest selling vehicle in the US. GM is making a $27B investment in the EV market and announced plans to offer 30 all-electric vehicles by 2025.

Car makers around the world are ripping up their old business models hoping to adapt to a new world in which electricity replaces gasoline and diesel-powered ICE vehicles. Currently, almost all global automotive companies have established an EV manufacturing strategy and process with many offering a complete line of EVs of either new models or electric versions of their existing models. Some, like Volvo cars (currently owned by the Chinese company Geely), are abandoning the production of ICE powered vehicles altogether. American companies like Ford plan to electrify their entire model line, having recently released the all-electric F-150 Lightning. The iconic Ford F-150 truck is the largest selling vehicle in the US. GM is making a $27B investment in the EV market and announced plans to offer 30 all-electric vehicles by 2025.

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us

Keywords: Global Automotive Industry, Emerging Technologies, Electric Vehicles, Digital Twin, EV Manufacturing, Additive Manufacturing, Common EV Platforms, Collaborative Robotics, AI/ML, COVID-19, ARC Advisory Group.