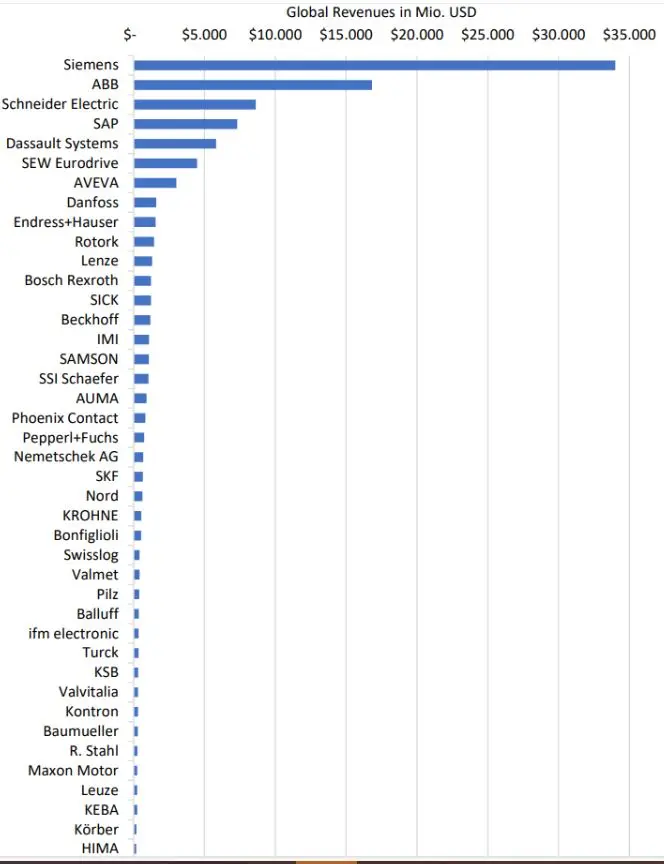

The chart below shows the largest European Automation companies (Global HQ in Europe).

Revenues are global and in USD.

Data source are ARC studies, so selected revenues may be missing, please see here

We did not see significant changes in the ranking over the last year.

Overall, the ranking reflects the portfolio and the breadth of offering in terms of products as well as regional coverage

Note that the revenues are global, so regional dynamics can impact the ranking as not all companies are distributed equal across the globe, though all have a high focus on Europe.

In some product markets we observed stronger dynamics, as selected companies were able to master the supply chain challenges better than others

ARC believes that some of the market share gains and losses may be permanent.

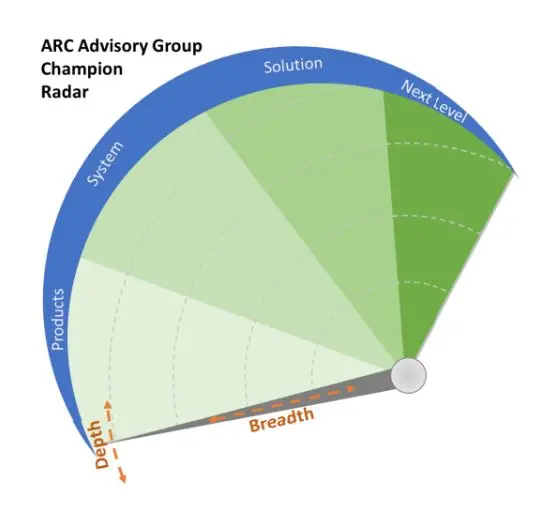

How to read: The ARC Champions Radar can be read like a speedometer. The further away a company from the center, the broader the offering is. The further up and right, the deeper the solution and digitalization know-how of a company. The heart of this analysis is the ARC database on products and solutions, on which analyst then perform a deep dive and individual adjustment on the company’s capability and portfolio.

Definition:

▪ Products: Means the company basically sells products only with little to no consulting and support to its customers.

▪ Systems: A supplier can sell a tailored system to its clients based on the clients’ definition. The supplier understands the needs and has the expertise to support the client, yet stays in a passive role

▪ Solutions: Going beyond system sales, including the joint develop and active involvement in creating client solutions.

▪ Next Level: Not only selling a solution for today, but enable the client to be future ready with digitalization know-how, experience and best practices.

As most companies are still structured around the traditional automation pyramid, we created champions radar along it as well.

Topics:

Field Instrumentation

Sensors & Identification

GMC, Motion & Drives

Process Control

Discrete Control

Industrial IoT

Enterprise & Plant Software

Supply Chain

Energy Management & Sustainability

This report features only 3 of our Champion Radars.

We prepared the following, please do not hesitate to contact us, if you have any questions.

Sensors & Identification

GMC & Motors & Drives

Energy Management & Sustainability

Field Instrumentation

Industrial IoT (Networks, Routers, Switches)

Discrete Control

Process Control

Enterprise and Plant Software

Robotics & Drones

Supply Chain

Infrastructure and Buildings

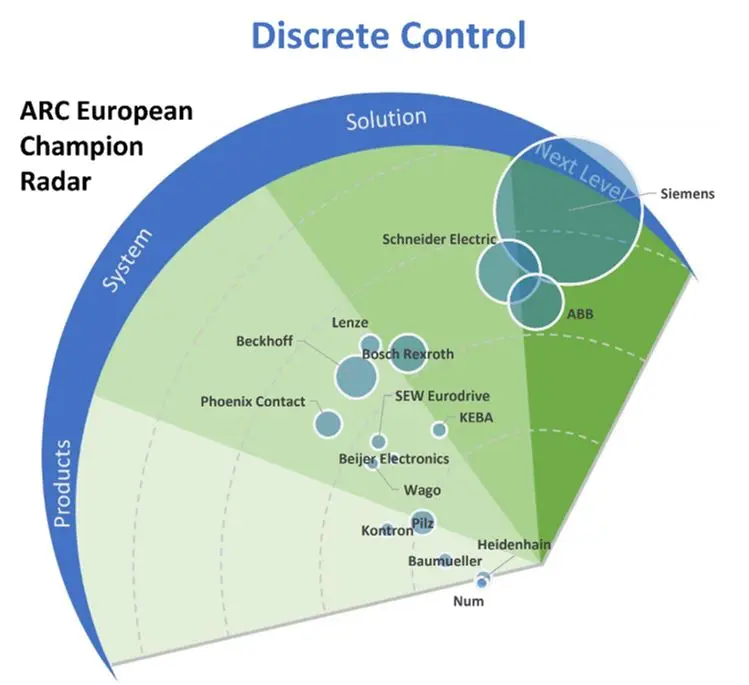

Products included here include AI in Machinery, CNC, Edge Controller, GMC, IPCs, IO Modules, Machine Safeguarding Solutions, PLCs, Operator Panels, Compressor Monitoring & Controls

The evaluation included:

product offering

technology leadership

capabilities to serve end users and OEMs

Vertical expertise

capability to serve small as well as larger projects / customers

application expertise

IoT know-how and expertise

strength in services

usage of open platforms and standards,

We focused on the main companies.

The following slide includes some interpretation, if you are interested in a detailed discussion, please contact us.

A wide field of suppliers with both general and specific offerings.

Most European suppliers see themselves as solution providers in that they work with customers to find the right solution. The breadth of the solution can vary from a custom configured IPC to a full automation strategy for a machine or plant.

Not all suppliers address machinery and end user markets. Baumüller, Num, and Heidenhain focus primarily on machine builders. This analysis also considers capabilities of suppliers to serve end users with solutions and digitalization know-how.

Many suppliers aim to move away from their traditional revenue streams to become broad solution providers. This may include brand labeling as well as in-house developments, often with partners. Examples include Wago (edge), SEW (IPC), Bosch, and Phoenix Contact. The strategy is to grow revenue with existing clients as solution know-how and portfolio breadth develop over time.

Beckhoff and B&R (ABB) are examples of suppliers that developed their portfolios from pure automation to include mechatronics and machines. With a different background, Keba and Rexroth have taken a similar approach.

Siemens, Schneider Electric and ABB stand out with deep application and solution know-how and broad portfolios. They typically work together with key customers to develop the future of automation in key markets.

Some suppliers portrayed here also offer electrical cabinet construction

Top European Automation Companies

Champion Radar

Economic Environment

Future Automation Architectures

Company Profiles

European Automation Landscape

Methodology

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

Obtain more ARC In-depth Research at Market Analysis