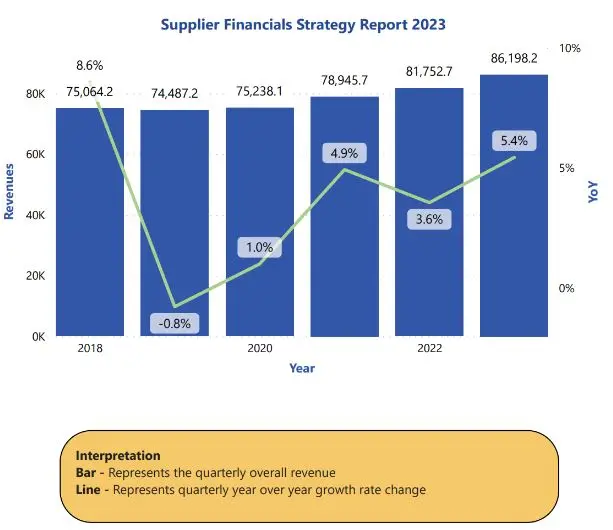

In this Insight, ARC Advisory Group includes the most recent quarterly results for major automation suppliers that publicly report their results. To convert the revenues of non-US suppliers to US dollars, we average exchange rates for foreign currencies used for the entire quarter.

With this latest automation supply side-market update, ARC has increased the number and breadth of automation suppliers covered, based on a combination of publicly reported data and ARC’s own extensive research database. We have also added selected business intelligence visualizations. Readers should contact their ARC client managers if they would like to gain additional access to this market intelligence as it applies to both regional and sector-specific supply side automation market trends.

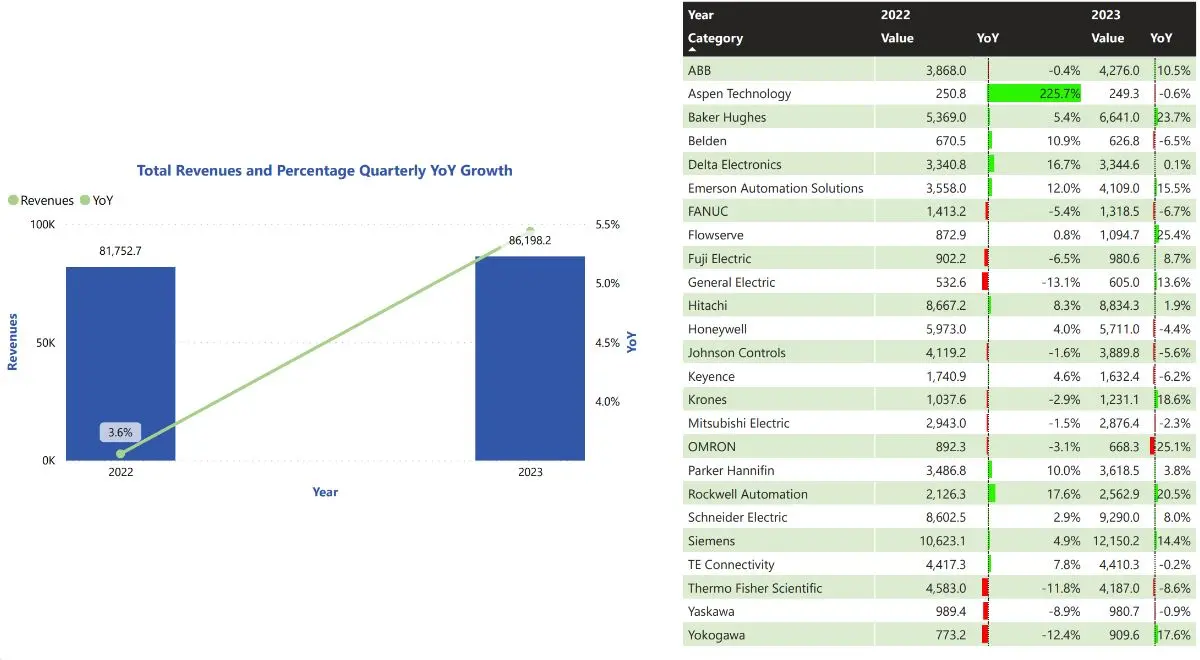

Financial results during calendar period from July 1 to September 30.

Growth for automation products market was in mid single-digits in Q3 2023 compared with the same quarter last year.

Most industrial companies reported growth in this quarter.

Growth contributors include food and beverage, chemical, pharmaceuticals & biotech, buildings & infrastructure, semiconductor, machinery, and water & wastewater industries.

Industry 4.0 drives smart manufacturing and remote monitoring of plant operations.

The future of manufacturing is digital, and AI adoption can boost productivity.

Energy-efficient automation technologies optimize energy usage, reducing operational costs and environmental impact.

Integration of digital technologies in manufacturing promotes automation, leading to connected, data-driven smart factories

Most automation suppliers are showing growth in this quarter.

Advancements in automation technologies (AI, machine learning, robotics, IoT) foster innovation and automation across industries.

Automation plays a crucial role in managing complex and globalized supply chains, optimizing inventory, logistics, and supply chain activities.

Increased investment in 5G networks contributes to the growth of the electronics and semiconductor industries.

The automotive industry experiences growth driven by green energy and sustainability, with a significant demand for electric vehicles from developed and developing nations.

Electric vehicle demand becomes a key factor in the overall growth of the automotive industry.

Smart automation and AI are reshaping machine builders, fostering innovation and efficiency in manufacturing processes.

Growth is driven by sustainability and environmentally friendly business practices.

Key technology trends include AI, ML, RPA, 3D Printing, Edge Computing, Autonomous Vehicles, Drones, and Supply Chain Automation.

Robotics and automation enhance safety, quality, and profitability in food processing, packaging, and retail through optimized monitoring and control.

Autonomous vehicles and drones optimize routes, reduce costs, and enhance speed and accuracy in various sectors.

Digital technologies are increasingly used for automating plants and processes.

Industrial IoT and digitalization are pivotal for boosting automation market growth.

Growing emphasis on cybersecurity as automation technology becomes more prevalent.

Technologies like autonomous robots, RFID tracking, and predictive analytics optimize inventory management, order fulfillment, and distribution.

Smart manufacturing transforms traditional operations into flexible, efficient, and data-driven processes.

The hydrogen industry drives growth in the process control instrumentation market.

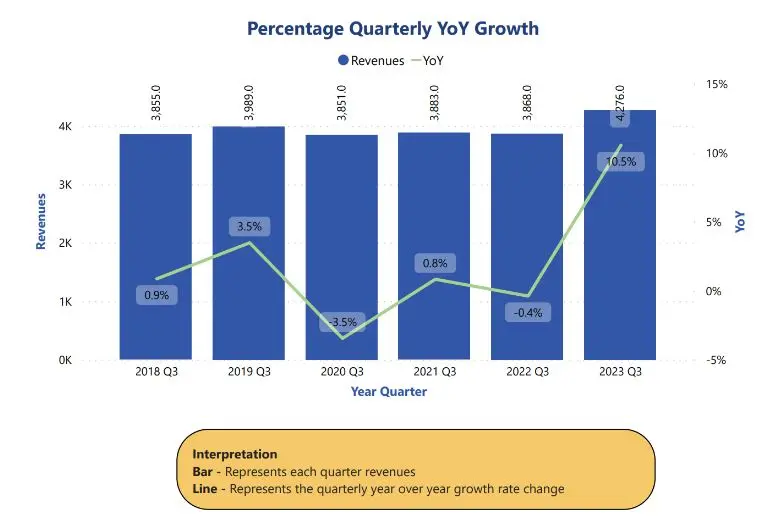

Q3 YoY

ABB recorded a slowdown in revenue growth and reported a continued decline in orders as the group posted third-quarter earnings in line with forecasts.

ABB noted some signs of stabilization in China, its second-largest market and said higher quarterly revenues and earnings were boosted by price increases outstripping cost inflation, and higher volumes.

The group also said it anticipated a low- to mid-single digit percentage rise in comparable revenue in the fourth quarter after reporting an increase in the third quarter.

ABB said its order intake fell during the quarter with double-digit growth in the United States, its biggest market, and growth in India and elsewhere in Asia partially helping to offset a decline in China, ABB's second-largest market, and Europe.

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

Obtain more ARC In-depth Research at Market Analysis