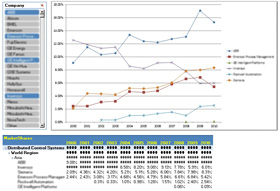

The Automation Expenditures for Production Machinery Market Research Study delivers current and historical market analysis plus a five year market and technology forecast. This market report is a compilation of automation equipment expenditures used in industrial production machinery. ARC used market data from 13 different automation products that ship to original equipment manufacturers (OEM) of industrial production machinery. ARC’s production machinery automation market report includes shipments to 22 industrial machinery segments that are used in a wide range of discrete, process, or hybrid industrial manufacturing operations. This report does not include cabinets or any mechanical structure of the machinery; it is strictly focused on the automation delivered to the OEMs. The scope section of this report provides a full description of each machinery segment, the type of machinery included in each segment, and a full description of the automation products.

The analysis in this report factors in the trends in the global manufacturing environment to assess the evolution of automation and services for production machinery to provide an outlook for automation. Insight into adoption trends in each machinery sector regarding sensors, digital automation controls, and safety technology that are all essential to building an Industrial Internet of Things (IoT) ecosystem strategy for machinery services are further expanded.

As manufacturing evolves with the introduction of digital twins, artificial intelligence, machine learning, and autonomy, production machinery will need to be adapted and designed to meet the expectations of manufacturers. Machines need to be redesigned to support an increasingly greater variety and number of sensors that allow for interrogation, fault detection, failure prediction, and more performance analysis. Evaluation of machine performance is changing, as customers and machine builders begin connecting machinery and monitoring production more closely to determine optimal operating conditions. This has become the predominant business case for developing an ecosystem built on Industrial IoT in the industrial machinery market.

In addition to providing a five-year market forecast, the Automation Expenditures for Production Machinery market research report provides detailed quantitative current market data and addresses key strategic issues as follow.

End users will seek automation with predictive maintenance, as opposed to preventive maintenance. Preventative maintenance has been the protection against unscheduled downtime, which costs time and money and significantly impacts productivity and availability of production machinery. With the trend toward digitalization, provide technology so that end users can identify degrading assets and predict failure well in advance using data from smart devices with built-in connectivity.

Servo drives, for example, can monitor changes in current or voltage to detect changes in torque demand that could indicate a problem like bearing wear or breakdown in a moving machine part. Such technology along with advanced analytics supports predictive maintenance, reducing or eliminating the time spent on preventative maintenance because now asset owners can schedule repairs at a convenient time prior to catastrophic failure.

Servo drives, for example, can monitor changes in current or voltage to detect changes in torque demand that could indicate a problem like bearing wear or breakdown in a moving machine part. Such technology along with advanced analytics supports predictive maintenance, reducing or eliminating the time spent on preventative maintenance because now asset owners can schedule repairs at a convenient time prior to catastrophic failure.

While predictive maintenance has been kicked around for many years, even with a huge benefit that it offers to the asset owners, along with new technological environment of digitalization and advanced analytics, it is expected to gain rapid adoption in the market.

Systems are being updated with new features to fulfill many market demands and increase their value proposition, such as the growing demand for smart connected products based on, for example, Industrial IoT or Industry 4.0. Smart connected products provide opportunities to increase operational efficiency from the plant floor to the supply chain by optimizing data, information, and analytics ranging. Data gathering and communication capabilities via standard plant floor networking technologies have been built-in features of many motion controllers and servo drives for a long time. With Industrial IoT or Industry 4.0, smart machines, inventory systems, and production machinery will considerably improve industrial processes, driving the use of more automation. In addition, Industrial IoT or Industry 4.0 offers opportunities to apply new kinds of business models that will promote growth. For example, internet connectivity allows industrial devices equipped with AC drives to be controlled and monitored more intelligently than before, resulting in added value for industrial operations.

Industrial machine builders are struggling to identify the appropriate technologies and business structure to create an Industrial IoT ecosystem that improves their service value proposition. Like the play “Waiting for Godot,” Industrial IoT is full of so many interpretations many strategists end up waiting for some clairvoyant moment when all the pieces will come together. The fact is that there are some sectors that are simply not waiting for Godot. For example, the commercial office automation market is plodding ahead. Equipment suppliers in the building systems market are incorporating innovative technology to meet the growing demand for intelligent urban infrastructure. This comprehensive service offering presents a win-win proposition for both equipment suppliers and building owners and operators. For owner-operators, it offers a strong value proposition since it makes their buildings smarter and more efficient. For the equipment suppliers, it represents a long-term opportunity to gain market share from local service providers. These capabilities enable OEMs to compete more effectively with third-party service providers and captive, in-house maintenance services alike, while improving both topline growth and profit margins.

This market study may be purchased as an Excel Workbook and/or as a PDF File. The Workbook has some unique features such as the ability to view data in local currency.

| MIRA Workbook | PDF File | |

| Worldwide (includes regional data) | Yes | Yes |

The research identifies all relevant suppliers serving this market.

For more information or to order the Automation Expenditures for Production Machinery Market Research report, please contact us.