Manufacturers, OEM machine builders, system integrators, suppliers, and other market participants increasingly view the industrial IoT edge as a cost-effective means of enabling digital transformation, sustainability, improved business performance, response to competitive and regulatory challenges, and new revenue streams. Ongoing evolution of these strategies has progressed edge functionality from simple protocol conversion, IT/OT convergence, and northbound protocol support to a target application execution environment.

IT organizations are pushing enterprise architectures to the edge, moving processing intelligence closer to the target devices, assets, and processes, while relying on the cloud for centralized compute, model training, storage, management, and scalability. Edge solutions help translate between the cloud and operational environments and reduce or eliminate latency, cost, and security issues associated with sending data to the cloud.

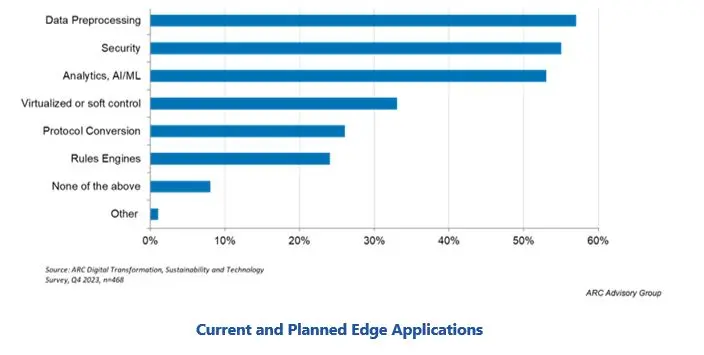

The results of a 2023 ARC Advisory Group survey of industrial manufacturers provide important insights into current and anticipated approaches to edge implementation. Key findings include:

Edge-to-cloud integration and edge compute are leading technology enablers driving digital transformation.

IT personnel were almost 30 percent more likely to have currently implemented or plan to implement edge compute relative to OT respondents.

Data processing, security, and analytics/AI are the most commonly pursued applications at the edge.

Industrial network infrastructure is a leading target platform for current and planned edge compute installations.

Adoption of cloud-based performance improvement enterprise applications, initially focused on analytics and now AI, heralded a concurrent focus on edge-to-cloud integration. The vast amount of data needed to fuel these applications resides in the myriad of industrial assets, devices, processes, sensors, and other production components that reside in the OT production environment. The OT environment is also the target for the optimized setpoints and other analytical outputs designed to minimize downtime, maximize asset utilization, and improve other business performance objectives. Edge computing can generate faster time-to-value, accelerate scaling, enhance security postures, and reduce TCO for these core initiatives.

Edge compute solutions can overcome limitations associated with extending the cloud into the OT environment in areas such as latency, reliability, and security, while also reducing cloud input data volume and egress cost. Data at the edge of the network can be aggregated and contextualized to send summary information and insights directly to the cloud, ultimately reducing cloud data storage costs. Edge functionality has likewise expanded digital transformation’s reach to remote, hazardous, and other distributed environments, simultaneously addressing the potential lack of reliable network connections and skilled IT personnel in the field.

Customers and suppliers alike are aligning their edge strategies to take advantage of the cloud’s centralized management, security, and scaling capabilities while preserving operational integrity by marrying these with on-premise edge capabilities. The descent of cloud-native containerized architectures to the edge is simplifying the deployment and management of edge applications, a key edge value driver, by providing a lightweight and portable way to package software and its dependencies. Industrial data can be pre-processed at the edge, sent to the cloud for analytics or model training, and then redeployed at the edge in a lightweight container.

Traditional use cases in areas such as asset management, production optimization, and predictive maintenance are now being paired with new use cases in areas such as product and service innovation, competitive excellence, and response to “new normal” business conditions. Low-latency processing capabilities at the edge are increasingly combined with emerging technologies such as AI/ML, AR/VR, video, analytics, and digital twins to serve new use cases in mobility, autonomy, enhanced field operations, connected remote experts, personnel tracking, safety, and even logistics and supply chain. 5G and private wireless are likewise driving a step-change in innovative use cases, particularly for mobility and autonomy, which will drive increased edge requirements.

Unlike many other technological improvements, edge solutions are not solely reliant on new installations. Ability to install edge solutions on existing equipment, typically via a software-enabled edge gateway inserted between the OT and enterprise environments, protects long-term, optimized investments while providing performance improvement possibilities.

In the process industries, it is not unusual to find assets still in place after 20 to 30 years of use. These processes are often fine-tuned over time, meaning that the assets and control logic stay in place long past their official lifespan. Manufacturers are retrofitting these installations with edge-enabled sensors and other data-gathering mechanisms to feed analytics-based applications that can both improve process performance and potentially extend asset life.

Traditional automation suppliers were late to the edge compute market relative to IT players, hyperscalers, and ISVs, but their arrival lends credibility to edge solutions. Virtually all suppliers targeting industrial digital transformation view the industrial edge as one of their major growth vehicles relative to smaller prospects in the traditional automation business.

Concurrent hardware developments, particularly in edge AI processing, continue to expand the realm of possibilities. This is particularly true for video analytics used to automate high-speed quality, inspection, and other vision-oriented applications. Industrial network infrastructure suppliers are responding by adding high-end new gateways and routers with advanced edge compute capabilities and more processing power to their portfolios. IT suppliers, such as Dell and HPE, are also extending their lines to the OT environment, while IPC suppliers continue to add powerful graphics and AI processors.

Over the course of 2023 ARC conducted a survey on the topic of Digital Transformation, Sustainability and Technology that yielded responses from over 500 participants drawn from a variety of industries. Close to 50 percent self-identified as Operations/Production/Manufacturing professionals, with another one-third identified as IT personnel. The remaining respondents were largely drawn from the engineering realm, along with some executive participants.

Adoption of cloud and edge-native technologies varies widely by industry as well as geography, although this survey was focused on the more cloud-friendly North American region. An important variable in pursuit of edge-to-cloud integration and edge compute is whether companies have cloud-based enterprise applications available to consume and deploy the data and insights generated at the edge.

Discrete industries tend to be the early adopters of industrial edge solutions relative to process manufacturing. Discrete industries represent greater opportunities for new technology adoption due to their more frequent equipment changeovers and ability to isolate specific parts of a process to evaluate edge solutions. Edge applications in the process industries tend to focus on maximizing the installed asset base, leaving legacy installations in place.

Along with questions concerning issues such as leading investment initiatives and adoption of specific technologies, such as AR/VR, survey respondents were asked to rate their current and planned industrial IoT edge implementations from the perspectives of both edge-to-cloud and edge compute, as well as deployed applications and implementation by architectural tier. Segmenting these results by OT vs. IT respondents exposed some revealing insights, as noted below.

Edge-to-cloud integration is either currently underway or already implemented by over half of all survey respondents. Almost two-thirds of IT respondents reported current or planned edge-to-cloud integration, a figure over 10 percent higher than that reported by OT personnel. This difference points to the preponderance of edge service to enterprise applications, particularly for the delivery of preprocessed data for consumption by analytics and AI, as well as the need for southbound delivery of trained models, optimized setpoints, and similar outputs.

Disparities in IT vs. OT responses were even larger concerning the topic of edge compute. While roughly one-half of all respondents have or plan to implement edge compute, two-thirds of the IT group reported current or planned edge compute implementations. This compares to just under 40 percent of OT respondents, or an almost 30-point difference in edge compute plans between the two types of organizations. Further information on these disparities is highlighted in the following sections.

Justification for the adoption of industrial edge solutions is increasingly driven by applications and use cases relative to the infrastructure emphasis that characterized early implementations. Edge applications can range from simple protocol conversion to monitoring, management, security, and many others. Maturation of the industrial edge concept is evident in the evolution from these initial applications in protocol conversion and device management to those focused on application-driven performance improvements and business outcomes.

Segmenting responses by IT vs. OT personnel reveals that IT is a primary driver of edge applications. IT organizations are pushing enterprise architectures to the edge, moving processing intelligence closer to the target devices, assets, and processes, while relying on the cloud for centralized compute, model training, storage, management, and scalability.

Leading edge applications targeted by survey respondents confirmed the ongoing emphasis on data preprocessing, security, and analytics, typically in service to predictive maintenance, reduced downtime, and improved production efficiency initiatives. The ongoing need for data preprocessing reflects not only the legacy role of the edge in insulating upper-tier enterprise applications from the potentially massive northbound deluge of data points generated by production processes and automated sensors and equipment, but also the escalating need for data ingestion and preprocessing for the burgeoning number of analytics-based applications.

Analytics-based applications are important at the edge due to their ability to drive incremental improvement via local data availability and faster time-to-value for edge applications. Real-time analytics support a variety of management applications, such as OEE, as well as video processing for automating high-speed quality, inspection, and surveillance, rapid situation response, and many others. Quantifiable returns from these activities include operational performance improvement, maximum asset utilization, reduced travel and support costs, and many others. Edge execution helps ensure low latency and determinism requirements are met.

Virtualized or soft control was also mentioned by one-third of respondents, along with legacy protocol conversion and execution of simple rules engines. Virtualized control, particularly logic control, is perceived as an opportunity to consolidate control and other workloads on a single containerized platform. This integration reduces hardware requirements while also improving manageability and scalability.

Executive Overview

Edge Compute Value Proposition

Survey Reveals IT Driving Edge Adoption

Recommendations

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

Obtain more ARC In-depth Research at Market Analysis