Introduction

To be able to provide our Advisory Service clients with holistic coverage of the impacts of the COVID-19 pandemic on various markets, ARC Advisory Group publishes latest Automation Index as a Special Report in PowerPoint format. This concise report focuses on the quantitative rather than qualitative aspects.

We have adopted our CapEx calculations to line up with the automation indices, but this did not result in significant changes to the overall dynamics.

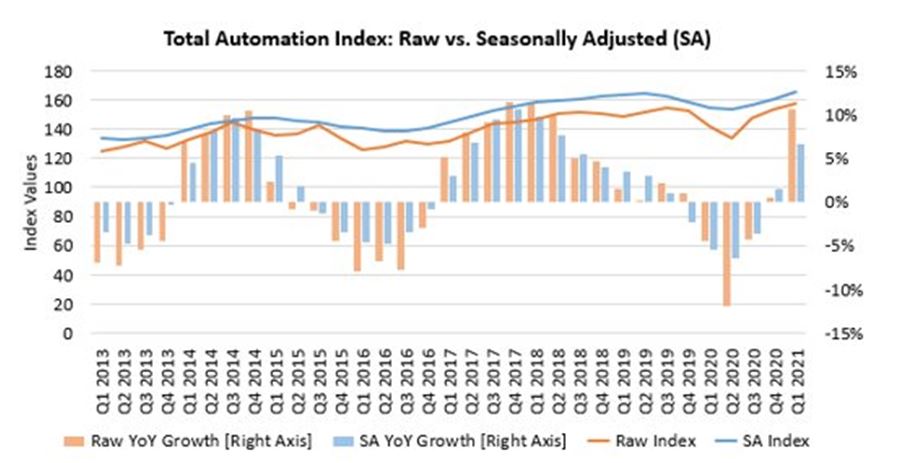

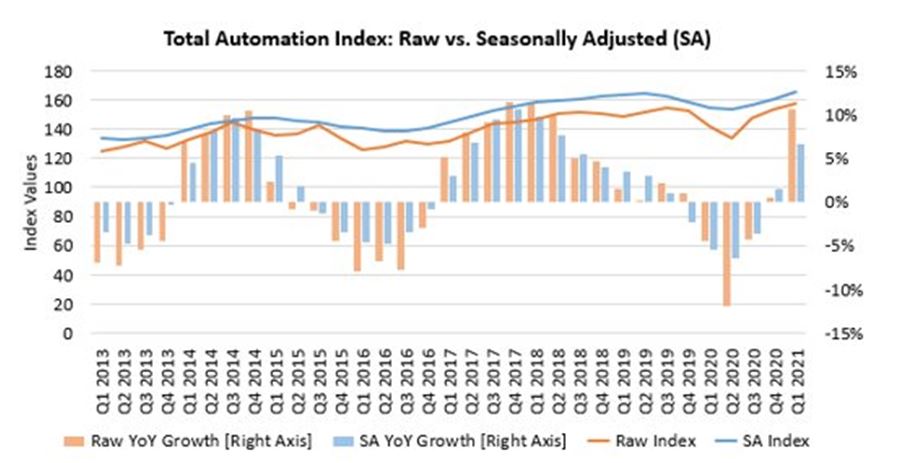

Automation Index: Raw vs. Seasonally Adjusted Data

- Almost all the automation companies recovered or saw a good growth in the range of mid to higher single-digits in Q1 2021.

- Asia region is the main growth engine in Q1. China, Australia and Taiwan are the key drivers from Asia.

- While China continues to be the growth driver, Europe and the US markets are catching up.

- Most of the industrial companies started experiencing a recovery but at different levels, for example aerospace sector is still at slow phase, but defense sector is performing well.

- The pandemic did not have a major impact on software, compared with hardware, as the software market performed relatively well compared with hardware during the year 2020.

Americas

- In the Americas, the raw index shows that quarterly YoY development has seen an upward trend in Q4 2020 after experiencing declines in the first three quarters of 2020. And the market grew at higher single-digit in Q1 2021.

- The upward trend was mainly due to recovery in some of the major end-user markets.

- Demand from pharmaceuticals & biotech, mining, buildings, semiconductor and water & wastewater has improved. Aerospace is still facing challenges, but defense is performing well.

- Continued demand for building automation and energy management technologies.

Europe

- Automation markets in Europe experienced a double-digit growth value of about 14 percent in Q1 2021 on YoY basis. This is the highest growth compared with other regions’ growth in Q1 2021.

- Automotive and machinery industry sectors are the key sectors for Europe region and these sectors had experienced declines since mid-2019, mainly due to transition to electric vehicles, slow growth in end-markets, and the COVID-19 pandemic in 2020. However, these industry sectors started to see a recovery in Q1 2021.

- It appears that automotive sector recovered a bit earlier than expected. Demand from food & beverage, pharmaceuticals, and biotech was also good. Strong demand from electronics & semiconductors in the Asia region helped European automation companies.

Asia

- Asia was the only region to experience a relatively quick recovery from the COVID-19 pandemic crisis as the region started to see a good growth rate in Q4 2020 compared with other regions. Asia’s automation market did not experience strong declines like other regions experienced.

- Asian automation market experienced a growth of about 11 percent in Q1 2021 on YoY basis. China’s economy has seen a speedy recovery from the COVID-19 pandemic registering a strong YoY growth of over 20 percent in Q1 2021.

- Electronics and semiconductor remained positive during 2020 and automotive started to experience a recovery in Q1 2021.

- Increased investment in 5G networks and lithium-ion battery production also helped China, Taiwan, and other nations that produce electronics and semiconductor products.

Hardware versus Software

- Software segment was hardly impacted by COVID-19 as the segment saw lower single-digit declines only in two quarters of 2020.

- After experiencing declines since Q1 2020, the hardware segment showed signs of recovery from Q3 2020, continued the recovery path in Q4 2020 and registered a YoY growth value of about 10 percent in Q1 2021.

- Overall, the pandemic did not have a major impact on software, compared with hardware and it appears that hardware segment is also back to normal pre-pandemic levels.

- Software and services markets seem to gain more importance than before as industrial companies tend to invest in remote maintenance and operations, energy management, asset optimization, machine learning, artificial intelligence, IoT, and other emerging technologies.

Sentiment Index - Current Situation

- Despite uncertainty in March, index climbed again massively in April and was able to stay at a very high level in May.

- Situation is overall evaluated as very good.

- Variance/uncertainty dropped since March, indicating that the upswing is now really solid.

- This is confirmed by macroeconomic data and our automation index data for Q1.

- ARC tracks the quarterly movement of CapEx for industries, machinery markets, and automation markets. All of these confirm the forecasts by the sentiment index.

- Most automation markets are back to pre-crisis level.

- Production numbers in most industries are back to 2019 levels too.

- Machine builders are experiencing strong demand.

- As reported, there are shortages even in selected goods that lower output ranging from wood, to steel, to semiconductors.

Table of Contents

- Automation Markets - Including regional market development, hardware/software market development

- Sentiment Index - Monthly market tracker

- Machinery Markets - A brief non-medical overview

- End User Markets - An excerpt from our CapEx and revenue index

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us