Overview

This time it is different!

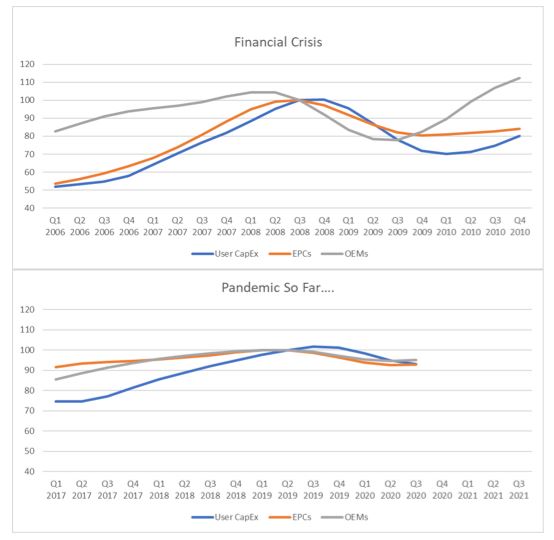

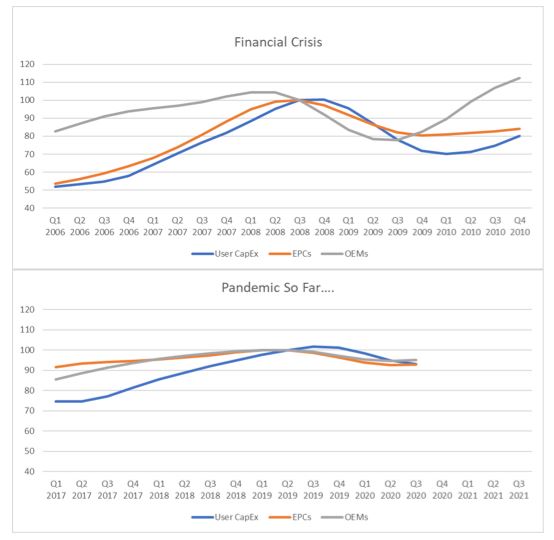

- In both the previous financial crisis and current pandemic, CapEx reaction had tended to lag OEMs and EPCs by one to two quarters

- We’re seeing less volatility than in 2008/2009

- In 2020, OEMs less impacted than EPCs and OEMs quite stable

- We are not coming out of a global boom phase – many industries are in different stages of the cycle

- In part, measures from 2008 crisis still impact 2020 developments

- We see that user revenues lead CapEx by one to three quarters on average

- Typically, CapEx are much more dynamic

- Markets have been hit by external shocks

- Automotive structural change

- Cement positive in China 2010/2011

- Oil & Gas price shocks

Methodology

To be able to provide our Advisory Service clients with holistic coverage of the impacts of the COVID-19 pandemic on various markets, ARC Advisory Group has decided to publish our latest Automation Index and Machinery Index as a consolidated Special Report in PowerPoint format. This concise report focuses on the quantitative rather than qualitative aspects.

We have adopted our CapEx calculations to line up with the machinery and automation indices, but this did not result in significant changes to the overall dynamics.

Seasonal Adjustments and Smoothing

ARC distinguishes between raw and seasonally adjusted (SA) data. Short-term impacts like the COVID-19 crisis do not show in SA data. ARC provides both variants when appropriate.

Discrete Manufacturing

Aerospace & Defense

- Defense rather stable

- By April, over 80% of flight movements were restricted

- Cargo capacity was down. WTO forecasts contraction of 13–32% in 2020

- Buffer in US supply chain has been low in recent years due to Boeing squeeze

- Airlines announce plans to reduce number of airplanes

- Machine tools hit hard, but automation overall stabilized

Automotive

- Structural crisis started in 2019

- Restart in April–June in some major vehicle-producing countries

- China pulls the whole industry up

- Big revenue losses and challenges in global supply chain

- Lower income in service sectors (short term lower automotive demand)

- Remote workers could impact structural demand

- Government measures to rescue companies (but with restrictions this time around)

- Electrification will hit selected parts of the value chain, but overall car demand will not drop in the short term

Electronics

- Rising unemployment rates - less money spent on electronic equipment (see revenues)

- Strong investment cycles, possibly with increased cycle volatility since 2011

- Coming out of slow investments in 2019, and followed cycle upwards in 2020

- Launch of new chip generations not postponed

- Automation to counter rising wages (machinery demand)

- Some CapEx to move to low-cost countries (also triggers some automation demand)

- Consolidated, just-in-time value chains, exposed to supply-side disruptions

Semiconductor

- Years of strong investment

- New chip generations not postponed, planned investments continued, innovation speed continued and triggered investments in production capacity and machinery

- Not severely impacted in 2020

- Semiconductor CapEx at record highs since late 2017

- Consolidated market with just-in-time value chains, so short-term exposed to supply-side disruptions

Table of Contents

- Discrete Manufacturing

- Aerospace & Defense

- Automotive

- Electronics

- Semiconductor

- Hybrid Industries

- Food & Beverage

- Pharmaceuticals

- Process Manufacturing

- Cement & Glass

- Chemical

- Metals

- Mining

- Oil & Gas

- Pulp & Paper

- Machinery Markets

- Automation Markets

ARC Advisory Group clients can view the complete report at ARC Client Portal

If you would like to buy this report or obtain information about how to become a client, please Contact Us