To provide our Advisory Service clients with holistic coverage of the various industrial and automation markets we cover, ARC Advisory Group publishes indices of revenues from automation, and machinery companies as well as indices of revenues and CapEx from end-user industries on a quarterly basis.

This Special Report in PowerPoint format is concise and focuses more on the quantitative than the qualitative aspects of the automation, end-user, and machinery industrial markets.

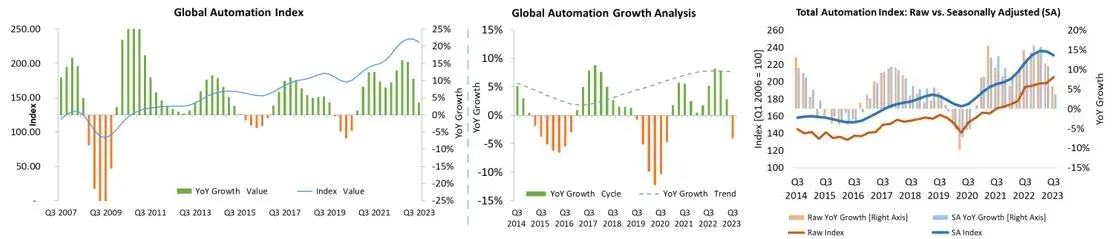

Global automation markets saw a low-single digit growth of about 4 percent in Q3 2023 on YoY basis. The registered growth is the lowest growth figure since the markets started bouncing back in Q1 2021.

The growth cycle shows a decline of 4 percent for the first time since the growth journey began in Q1 2021.

Majority of the growth of discrete automation segment was supported by execution of backlogs, higher volumes and prices.

Demand from process and hybrid industry segments continued to remain strong, while the demand from discrete industry segments weakened due to normalization (bottoming out) of backlogs and lower order patterns compared with 2022.

Strong demand in oil & gas, refining, petrochemicals, data center, infrastructure, renewables, aerospace & defense, power generation and electrical distribution segments.

On seasonally adjusted basis, Americas saw good growth rates compared with Europe and Asia.

Most companies’ orders notably for discreate automation saw strong declines on YoY basis, book-to-bill ratio is below 1.

Demand for automation products continued to grow in the US market. The registered growth in Q3 2023 was low compared with Q3 2022.

Growth was predominantly driven by large-scale projects, notably data center, infrastructure, energy, renewables, and other process industry segments.

Good demand for process automation, systems and electrical equipment (substation, power supply, distribution).

Strong growth from the US, Canada, and good growth from the Mexico and Argentina markets.

Growing demand in energy transition, electrification, renewables, chemicals, oil & gas, LNG, semiconductors, battery and EV sectors. Also, good demand in aerospace and defense segment.

The YoY growth cycle points no growth or stable in Q3 2023. But YoY growth trend remained almost stable in the Americas.

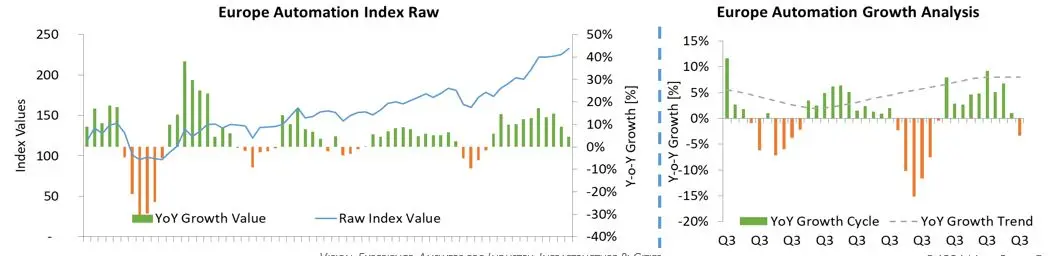

Automation markets in Europe continued to expand but at a very low level. The market saw growth of about 5 percent in Q3 2023 on YoY basis. The registered growth is the lowest since the market started to see recovery in Q1 2021.

The YoY growth trend shows almost stable growth, but the YoY growth cycle shows a decline of 3 percent for the first time since Q1 2021 when the market recovery started.

Slower demand for discrete automation segment and normalization of backlogs and lower/declining orders on YoY basis from user industries slowed down the growth both in revenues and orders, and this trend is expected to continue in the coming quarters.

While strong demand for process automation products, services, and systems from the process industry sector is expected to continue, demand from the discrete industries, including machine building, robotics, electronics, and semiconductors is expected to be weak. However, strong demand in the Americas and in defense sector also support growth of European vendors.

Trends: demand for automation, digitalization, electrification and sustainability continue to pull the growth in Europe.

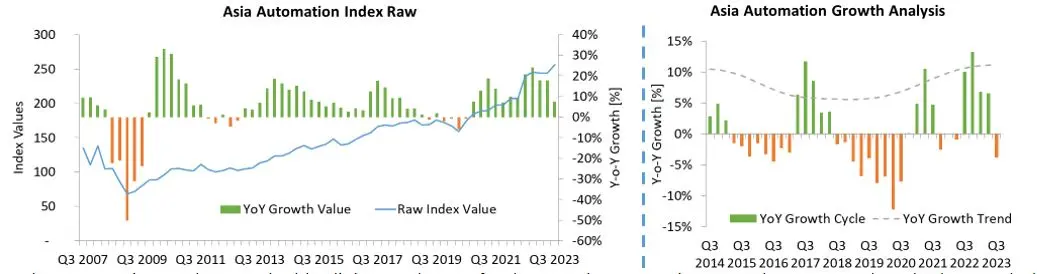

Asia’s automation market saw double-digit growth rates for the past six quarters in a row. The YoY growth cycle shows a decline of about 4 percent after registering double-digit growth rates in the last four quarters.

Market continued to expand but with a low growth of around 7 percent. The registered growth is the lowest since late 2021.

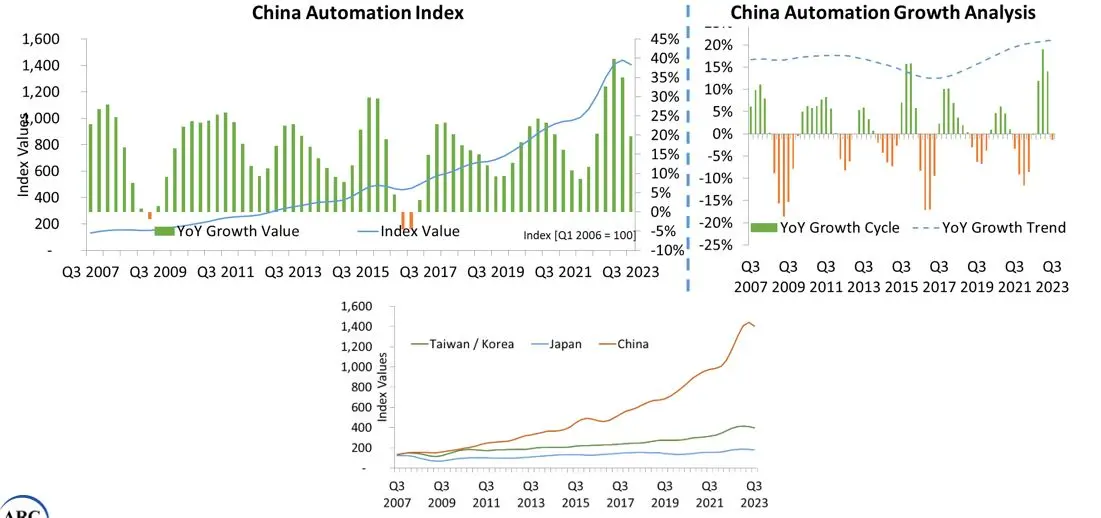

Slow growth in China continued in Q3 as well, no signs of recovery due to slower domestic demand as well as weak external demand. However, renewables segments seems promising in China.

Strong demand from India notably in machine building, process industries, infrastructure, data centers, and renewables sectors.

In Japan, the economy continued to expand due to increase in consumer spending, strong demand in electric power generation, power supply and distribution and electrical equipment sectors.

Slower demand from semiconductor, and electronics machinery sectors. Investments related to transportation, infrastructure, electrification, renewables, digitalization, decarbonization, and circularity provide growth opportunities.

Mid to high single-digits.

Orders growth in process and hybrid due to strong demand.

Weakening of demand in discrete automation (particularly in China and Western Europe). Orders bottoming out, and order normalization to continue for the next couple of quarters.

North America, Mexico, India, Japan, some Middle East countries expected to lead growth; Europe and China markets expected to see moderate growths.

Strong growth in aerospace & defense, chemicals, datacenters, metals & mining, oil & gas, renewables.

Modest/limited growth.

Process and hybrid industries demand is expected to remain strong in the next quarters.

Discrete automation segment expected to see recovery from latter half of the year.

Large-scale projects in electrification and infrastructure spending, and life sciences.

Automation Markets

Machinery Markets

End User Markets

Sentiment Index

ARC Advisory Group clients can view the complete report at the ARC Client Portal.

Please Contact Us if you would like to speak with the author.

Obtain more ARC In-depth Research at Market Analysis