Last week ABB hosted “Innovation and Technology Day” events for analysts and customers at its Auburn Hills (MI) robotics manufacturing and service facility. ABB provided an update on developments since its ABB Customer World event in Houston last March.

March to September is short period for a second update, but in April 2017 ABB surprised the automation market and acquired B&R, the Austrian-based machine control specialist, and one of the most innovative firms in the industrial automation market. ABB has also recently expanded its robotics operation in the US, so ABB had news to share.

As part of the event ABB Chief Digital Officer Guido Jouret updated customers on the ABB Ability strategy. I’ll focus on that aspect here, beginning with what Mr. Jouret said and ending with my impressions of what ABB is doing.

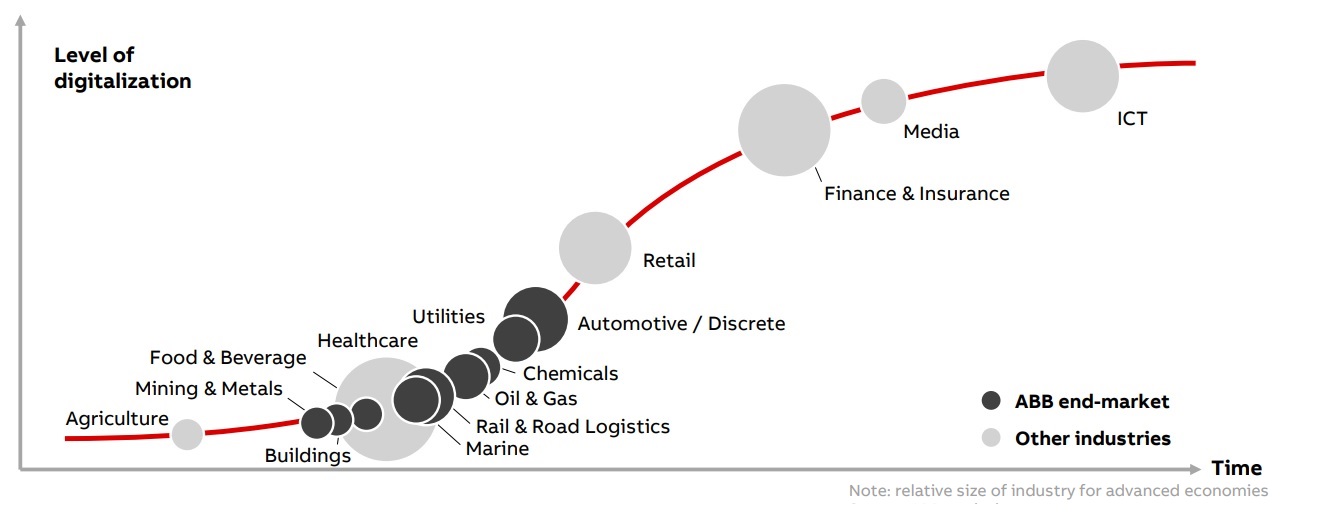

ABB sees the emergence of the Industrial IoT as a 2nd wave of digitalization, building on an earlier wave centered on the services sector (see figure). Most of the industries in this 2nd wave are already served by ABB.

Definitionally, the term “ABB Ability” refers both to platform and applications. At the March customer event, ABB identified 180 Ability applications, and these were selected from a group-wide comprehensive software inventory and evaluation. These apps will be “building on best-in-class IT” according to Jouret. For cloud, Ability employs Azure, Microsoft’s cloud application platform running on Microsoft data centers. Though ABB has partnered with IBM for Watson, Microsoft has been ABB’s principal software partner for many years and the primacy now extends to ABB Ability. This exclusive partnership is not viewed as limiting, since ABB does not see the Industrial IoT as a platform-oriented battle. Rather they believe that multiple cloud platforms will persist and in time “intercloud” integrations will mature, enabling end users to focus more the applications than on the platforms.

The number of ABB Ability apps becoming available on Azure is growing, and newer Azure features supporting on-premise, hybrid clouds, and application services (e.g. the Azure Stack and Azure Application Gateway) will add flexibility and value to these apps.

In terms of software development, the focus is on several dozen current projects designated as “Lighthouse” projects. Their number is expected to grow. A small internal organization is developing common software components as a service and support to the business units that are responsible for delivering the projects (and products). These will eventually form a common infrastructure serving both existing and new applications.

Though ABB might be accurately described as a laggard in terms of an Industrial IoT strategy, the ABB Ability plan tries to use this lateness as an advantage. Though this program is “equivalent” to GE’s Predix in the minds of many customers (and analysts) the contrast with GE’s program is marked. For example:

Summarizing this, I would say that ABB appears to be trying to build a program that will be analogous to Predix from the customer’s standpoint, but can be simpler, built far faster, and developed far more economically. Not being in the first wave can be a good thing!